Self Assessment Tax Returns

Self Assessment Tax Returns

Self-Assessment Tax Returns for 2021/2022 now need to be prepared. The deadline for paper returns is the 31st October 2022 with electronic returns due by the 31st January 2023 |

A Guide to Self-Assessment: Click here to download>>

Self Assessment Tax Returns

All company directors and self-employed workers in the UK must complete a self-assessment tax return each year. Here, we do our best to answer the most common questions about self-assessment in the hope that this will make the process easier for you.

What are the dates for the current financial year?

The UK tax year runs from the 6th to the 5th of April, so tax year 2020/21 for example started on the 6th of April 2021 and ended on 5th of April 2022.

How do I know if I need to complete a tax return?

You’ll need to send a tax return if, in the last tax year:

You were a company director - unless it was for a non-profit organisation (such as a charity) and you didn’t get any pay or benefits, like a company car.

You were self-employed - you can deduct allowable expenses.

You got £2,500 or more in untaxed income, for example from tips or renting out a property - contact the helpline if it was less than £2,500.

Your income from savings or investments was £10,000 or more before tax.

Your income from dividends from shares was £10,000 or more before tax.

You made profits from selling things like shares, a second home or other chargeable assets and need to pay Capital Gains Tax.

Your income (or your partner’s) was over £50,000 and one of you claimed Child Benefit.

You had income from abroad that you needed to pay tax on.

Your taxable income was over £100,000.

Your State Pension was more than your Personal Allowance and was your only source of income - unless you started getting your pension on or after 6 April 2016.

If you’ve been told to send a return by HMRC

If you receive a letter from HM Revenue and Customs (HMRC) telling you to send a return but you don’t think you need to, check with your accountant. Ignoring the letter can lead to a penalty and fine.

How do I register with HMRC?

Registering with HMRC for a tax return is very straight forward. As a client of Orange Genie, we will apply to register you for Self-Assessment. Once you receive your Unique Tax Reference, (UTR) we can then apply to act as your agent. HMRC will send you an activation code that you need to forward to us. Once registered you will remain so until such time as HMRC decide a self-assessment is no longer necessary.

Do I need an accountant to complete my tax return?

Unless you're an accountant or some sort of mathematical genius, it probably is a good idea to seek expert advice especially if it is your first tax return. Being just one minute late on your tax return could result in an automatic £100 fine and let’s be honest the form can be tricky and confusing, and the last thing you want to do is resubmit the form because you have made an error.

Also don't forget a good accountant will be up to date with legislation and there might be a tax saving scheme you could be registered on which could save you hundreds of pounds!

What information do I need for my self-assessment tax return?

If you’re a client of Orange Genie Accountancy, your accountant will send you a link to a questionnaire to make sure we capture all the relevant data. A self-assessment has to include all income earned from all sources in the tax year. Below is a basic list of the main things we will need:

Salary and benefits in kind from all employments in the period.

Self-employed profits.

Income earned overseas.

Rental income.

Investment income such as bank interest and dividends.

Capital gains such as company closures or the sale of a second property.

Personal Pension Contributions.

Charitable donations via gift aid.

Child Benefit payments.

Do I need to keep copies of my accounts?

An HMRC investigation can go back up to six years, so we’d advise you to hold onto your records for at least that long. You’ll need to keep all your accounting records, whether they’re electronic or on paper. Orange Genie Accountancy clients will find this easiest to do online through FreeAgent, where they can access all their accounting information at any time.

What is the payment deadline for tax year 2021/2022?

The deadline for payment is the same as the one for submitting an online return. For tax year 2021/22, HMRC should receive payment by January 31st 2023. If you pay later than this you may be liable for penalties. You can appeal against a penalty if you have a reasonable excuse.

What happens if I file a late return?

Your Orange Genie Accountant will do everything in their power to make sure you don’t incur any fines for late filing or payment.

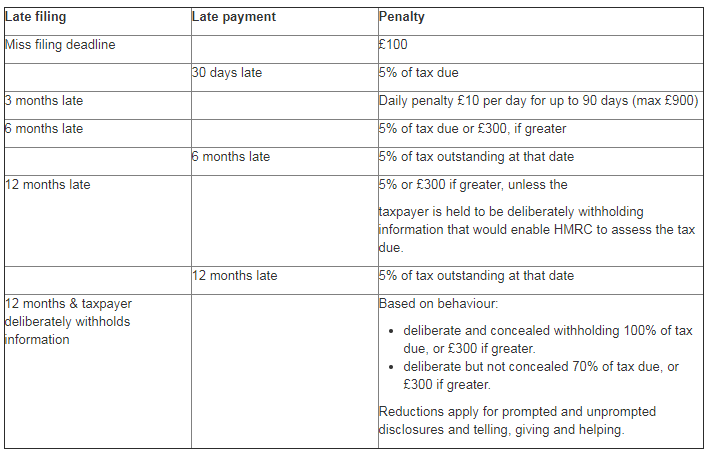

If for any reason you are late the following penalties apply:

For more information about how Orange Genie Accountancy can help you, please contact us on 01296 468 185 or email accountancy@orangegenie.com.

For more information about how Orange Genie Accountancy can help you, please contact us on 01296 468 185 or email accountancy@orangegenie.com.

Why Orange Genie Accountancy?

Orange Genie Accountancy offers fixed fee accountancy packages to contractors and freelancers. Each client has unlimited access to their own dedicated approachable and friendly accountant. All Orange Genie Accountancy accountants are specialists in the contracting market, so they can give you bespoke, high quality advice.

We will always keep you informed about anything that could affect you and your company. Our relationships with our clients are extremely important to us so we'll be in touch often, whether it be face to face, over the telephone or email.

Our packages start at £75 + VAT a month for an online service. Our most popular package is £120 + VAT a month which provides you with your very own dedicated accountant as well as:

Unlimited accountancy support

Face to face meetings so we can get to know you and understand your contracting goals

Proactive contact

Director and employee payroll

Annual Return

Self-Assessment Return

A fully compliant service so you are safe in the knowledge that you are meeting your legal obligations

And much more, including access to wealth management advice, IR35 reviews and pensions planning.

If you would like to appoint Orange Genie Accountancy as your accountants please either fill out our enquiry form or give one of our friendly expert accountants a call on 01296 468 185 or email accountancy@orangegenie.com.